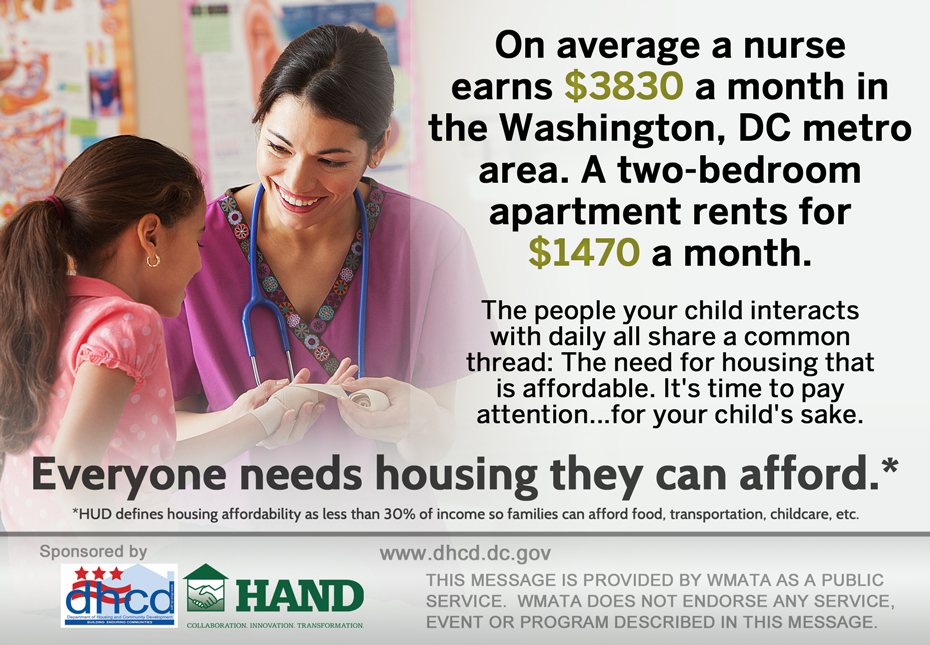

Have you ever thought about who needs affordable housing? This public service announcement (PSA) campaign raises awareness around the relationship between housing affordability and the average take home pay of some of our most valued members of society: the professionals who take care of our children.

Have you seen this PSA?

A Day in the Life… A Nurse

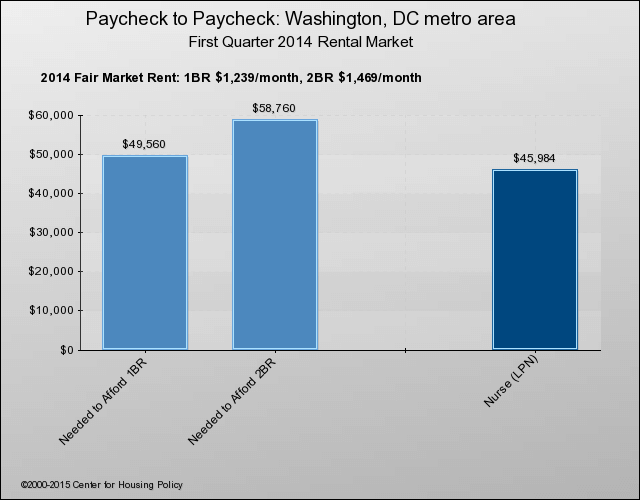

Sponsored by District of Columbia Department of Housing and Community Development, HAND has launched the first PSA in the “Day in the Life of a Child” series. Promoted on Washington Metropolitan Area Transit Authority (WMATA) metro buses and rail platforms for the month of June, this initial concept focuses on a nurse (LPN) who earns the average salary of $45,900/year and highlights the disparity between the nurse’s income and what’s really needed to be able to afford a two-bedroom apartment in the D.C. area ($58,760/year). According to HUD’s affordability formula, a nurse would need to earn thousands of dollars more to be able to adequately afford the home. Including rent, what else does our nurse have to pay for? Food, utilities, health/dental care, child care, transportation, insurance, clothing, savings, etc.

Housing that is affordable is essential to the Washington region’s economic growth, a thriving business community and high quality of life for our workforce and most importantly our children.

Data for the PSA series is supplied by

National Housing Conference Paycheck to Paycheck

online tool.

Department of Housing and Community Development

The mission of the Department of Housing and Community Development (DHCD) is to create and preserve opportunities for affordable housing and economic development and to revitalize underserved communities in the District of Columbia.

Learn More

www.dhcd.dc.gov

HAND is proud to have them as our government sponsor for the WMATA PSA series.

National Housing Conference

The National Housing Conference (NHC) is dedicated to helping ensure safe, decent and affordable housing for all in America. As a division of NHC, the Center for Housing Policy specializes in solutions through research, working to broaden understanding of America’s affordable housing challenges and examine the impact of policies and programs developed to address these needs.

Paycheck to Paycheck is the National Housing Conference’s online tool that compares the median wages of workers in 80 different occupations to median housing costs in 210 metro areas. Policy makers and affordable housing advocates can use the Paycheck to Paycheck tool to find out which workers face challenges in accessing affordable homes to rent or buy and use the data to demonstrate the need for more affordable housing in their community.

Learn More

www.nhc.org/paycheck

HAND thanks NHC for the use of its dedicated research reflected in its 2014 Paycheck to Paycheck interactive tool.

Sponsorship?

If you are a government agency interested in sponsoring one of the upcoming PSAs, let us know! Email Heather Raspberry, hraspberry@handhousing.org, and we’ll be in touch.