Residential Construction Activity in the Washington Metro Area

Photo courtesy of Scott Lewis

By Lisa A. Sturtevant, PhD

In the aftermath of the recession and housing market downturn, residential construction activity has been increasingly fairly steadily. However, the pace of new housing construction remains below long-term levels and the types and prices/rents of new housing being produced does not sufficiently meet demand. As demand for home ownership increases, the population of younger renters grows more slowly, and the number of lower-wage workers expands in the region, there is a great need for lower-priced home ownership opportunities and apartments and other rental homes with lower rents.

Some key findings from the residential permit data released from the U.S. Census Bureau:

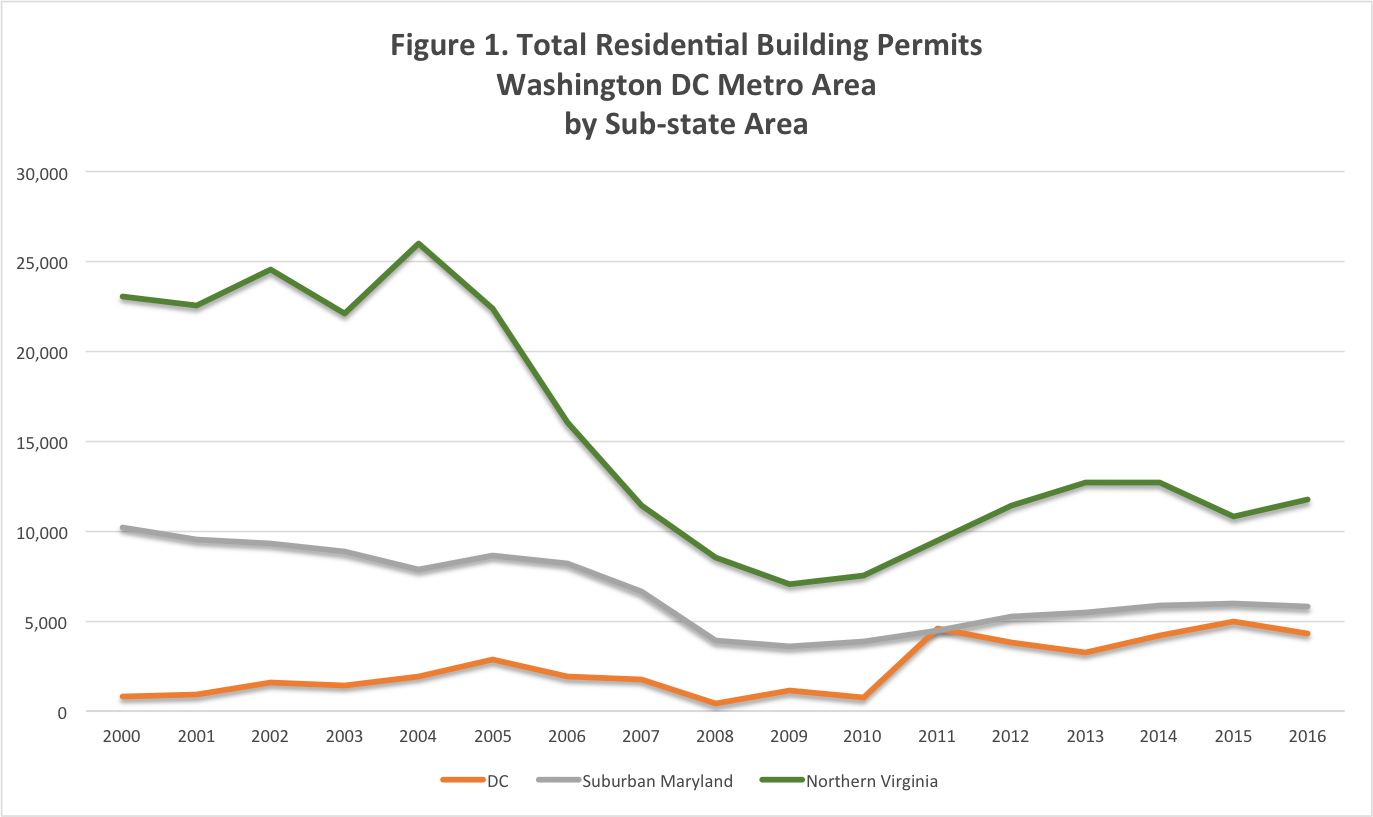

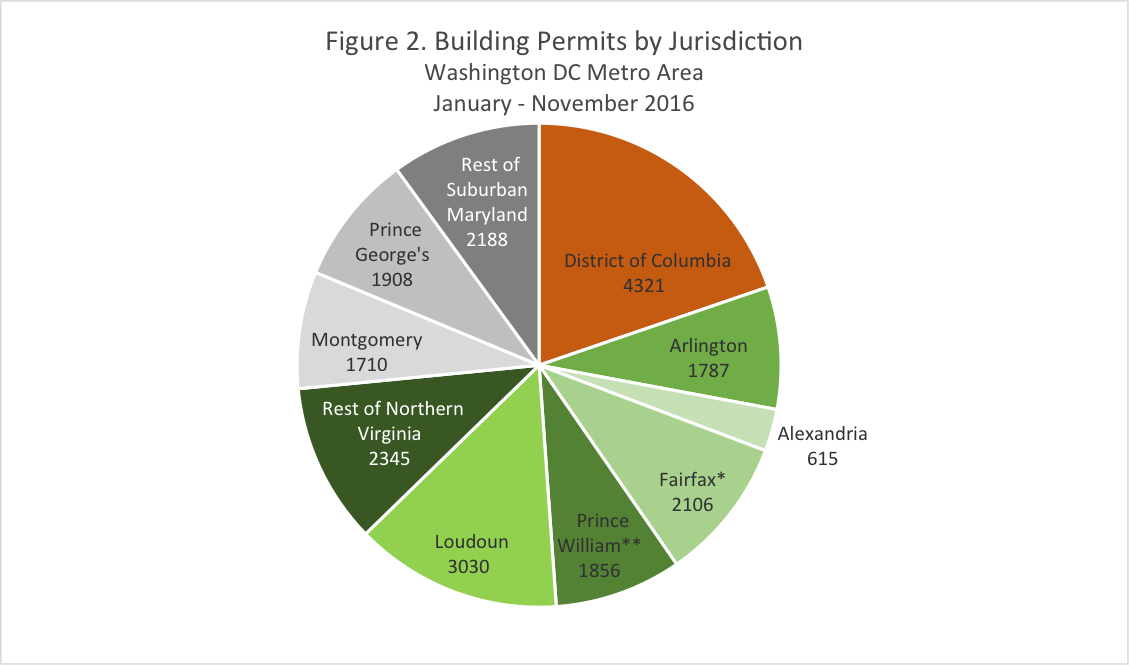

Residential construction activities to grow steadily but still remains below long term levels regionwide. Over January through November of last year, there were about 22,000 permits issued for the construction of new residential housing units. The 2016 residential permitting activity included 4,321 building permits in the District of Columbia, 5,806 building permits in Suburban Maryland, and 11,739 building permits in Northern Virginia. Residential permitting activity in the region has been increasing steadily since 2009, but remains below the 2000-2016 annual average (~25,000), suggesting that new home construction has not been sufficient to meet the demands associated with population growth.

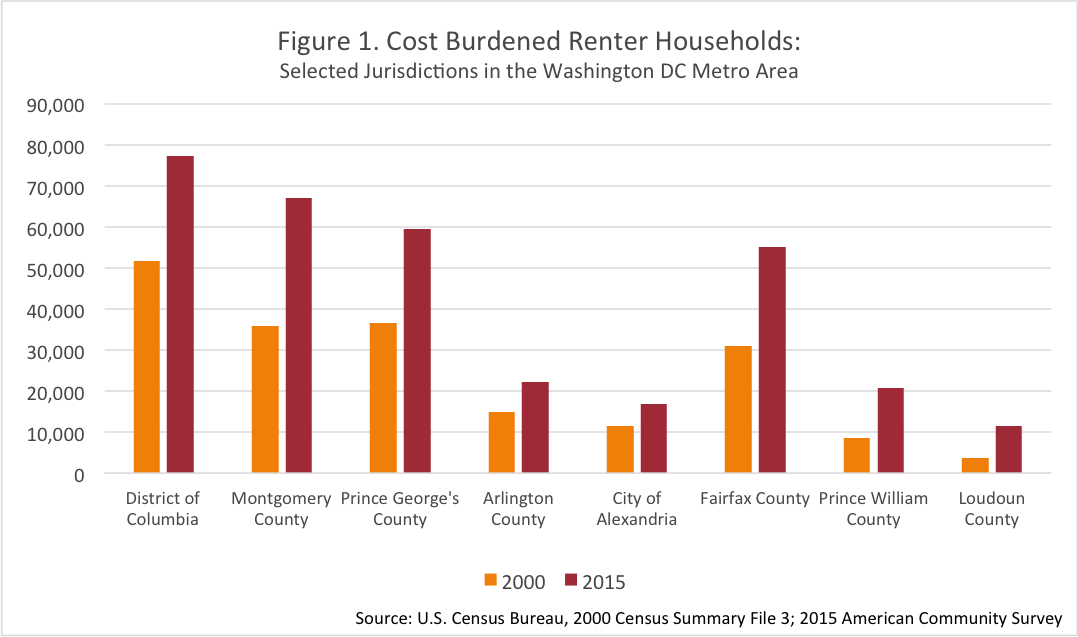

[Figure 1]One-fifth of the residential construction activity in the region was in the District of Columbia in 2016. While residential construction activity has increased throughout the region, the District of Columbia still accounts for one-fifth of new permits. About a quarter of the permits were for housing in Suburban Maryland and a little over half were in Northern Virginia. By contrast, before the recession, only about five percent of permits for new residential units in the Washington DC region were in the District of Columbia. The District’s share of new permits has slipped slightly, to 20 percent in 2016 from 23 percent in 2015.

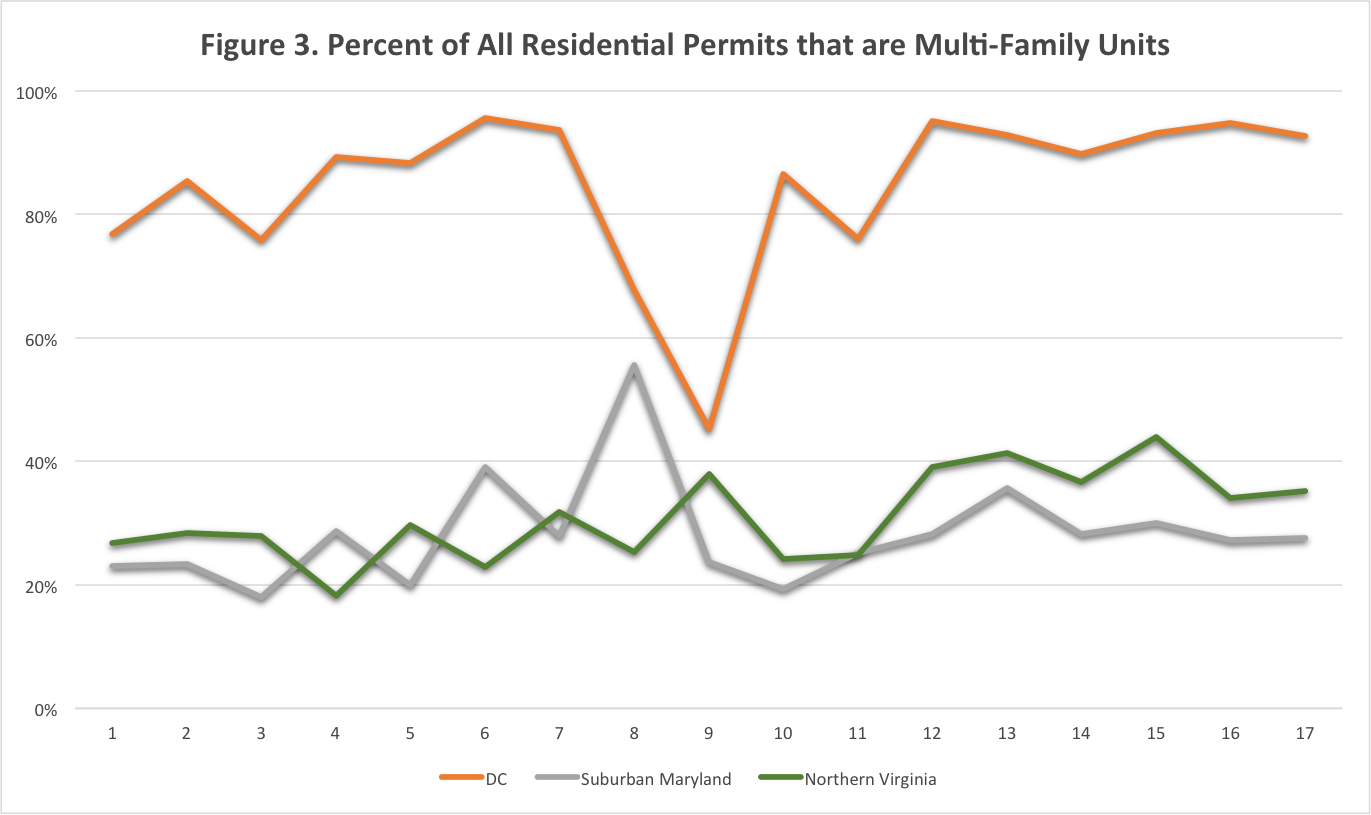

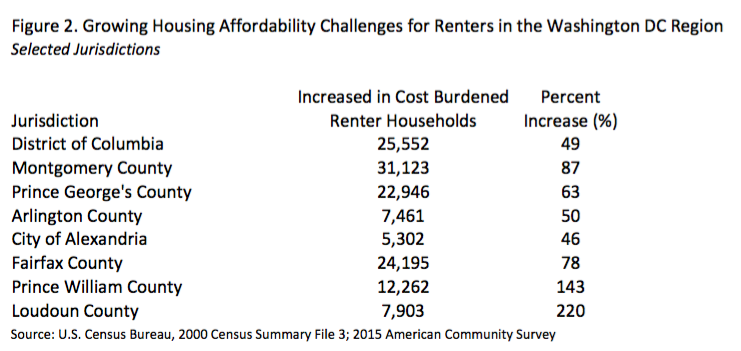

[Figure 2]Multi-family construction remains strong though new single-family construction is on the rise. In 2016, 44 percent of permits for new residential construction in the Washington DC region were for multi-family units, including nearly all (93 percent) of the permits in DC, 35 percent in Northern Virginia and 28 percent in Suburban Maryland. Historically, over the past 16 years, about 38 percent of permits in the region were for multi-family units so the current share remains higher than average. However, over the past two years, the share of multi-family units has declined somewhat, generally because of a slight decline in the share of permits issued in DC.

[Figure 3]Home prices and rents in the Washington DC region continue to climb. Recent data from MRIS have shown that home prices in the metropolitan area have now matched the record high set during the housing market boom. The median sales price in December 2016 was $410,100, slightly higher than the previous record high price of $408,000 in 2014. As typical, there is wide variation in home prices throughout the region that reflects location as well as home types. For example, in the District of Columbia, the median sales price was $550,000. In Fairfax County the median home price was $470,000 and in Prince George’s County was $265,000.

Rents have also been on the rise, and new multi-family construction has skewed substantially towards luxury, higher-rent apartments. Even as concessions at new apartment buildings have increased, rents in buildings, particularly in DC and in the closer-in suburbs, are often only affordable to very high-income renters. According the 2015 American Community Survey data, the median rent in DC was $1,417 in 2015; however, the median rent for units built in 2014 and 2015 was $2,334. A household would need an income of more than $93,000 in order to afford the median rent in a new apartment building in the city.

Homelessness remains an intractable problem in the District of Columbia. Even as new residential construction increases, there remains insufficient housing affordable to all residents in the region. A recent survey by the U.S. Conference of Mayors found that Washington DC has the highest rate of homelessness among the nation’s 32 largest cities. The ability for the region to expand the housing supply will depend not only on land use and zoning changes that encourage more housing, but also policies that promote the development of housing for our region’s most vulnerable residents.

Recently BisNow featured HAND Member,

Recently BisNow featured HAND Member,